Start Smart, Start Early: The Young Adult’s Guide to Building Wealth🤓

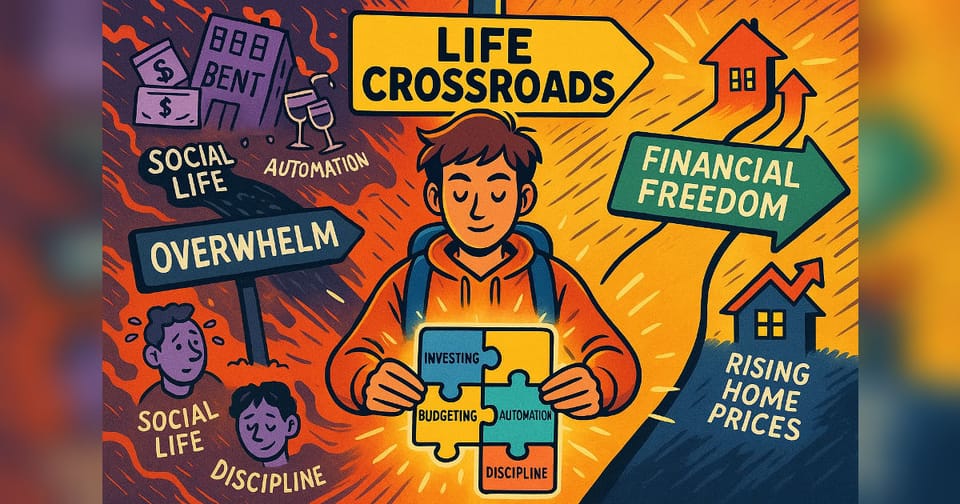

Building wealth in your 20s and 30s can feel overwhelming🫨

You’re juggling rent, bills, social plans, career pressure—and somewhere in between, you’re told you should also be saving, investing, and “planning for the future.”

But here’s the truth: you don’t need a high salary or perfect financial knowledge to start building wealth. What you do need is intention, consistency, and a clear system.

Whether you’ve just landed your first full-time job or you’ve been working for a few years, these early decisions matter more than you think. The habits you build now—automating your investments, avoiding common mistakes, balancing your expenses, and making smart money moves—become the foundation of your financial future.

This week, we’ll break down exactly how to grow your wealth even on a modest income, how to invest when you’re busy, and how to avoid the traps most young adults fall into. With the right mindset and simple strategies, you can start building real financial security—one step at a time.

Today’s Headlines🗞️

How to Build Wealth in Your 20s and 30s — Even If You Feel Behind

Description: This article breaks down the essential habits and mindset shifts young adults need to start building real wealth—regardless of salary or how late they feel they’re starting. From mastering your cash flow to automating investments and avoiding lifestyle creep, it offers a practical roadmap for anyone in their 20s or 30s who wants to take control of their financial future and create long-term stability.

Why Automating Your Finances Is the Easiest Way to Build Wealth

Description: This article explains how automation can remove stress, emotion, and inconsistency from your money habits. From automatic investing to bill payments and budgeting systems, it shows how a “set it and forget it” approach helps young adults grow wealth effortlessly while staying focused on their careers and personal goals.

Just Landed Your First Job? Here Are the 7 Money Moves You Can’t Ignore

Description: CNBC outlines the key financial steps every young professional should take when starting full-time work—from building an emergency fund to choosing the right retirement accounts. It’s a practical checklist that helps new earners avoid costly mistakes and establish strong financial habits early.

The Biggest Investment Mistakes Young Adults Make—and How to Avoid Them

Description: This video breaks down the most common missteps young investors fall into, such as chasing trends, timing the market, and being overly conservative. It offers clear, beginner-friendly guidance to help viewers build confidence and make smarter long-term decisions.

Must-Know Financial Tips Every Young Adult Should Master

Description: Investopedia provides a concise but powerful guide to the essential money principles young adults need—budgeting, saving, debt control, and investing basics. It’s the perfect foundation for anyone in their 20s or 30s looking to build wealth with clarity and discipline.

📌 This Week’s Principle

Small, consistent actions in your 20s and 30s matter more than perfect decisions.

You don’t need a high income or expert-level knowledge—you just need to start early, automate smart habits, and avoid the mistakes that slow most people down.

🔎 Principle in Practice

Build your foundation with these 4 core steps:

Start investing automatically every month, even if it’s just $50–$200.

Set up your first “grown-up” money systems: emergency fund, insurance, CPF/SRS strategy, and a spending plan.

Avoid beginner traps like chasing hot stocks, timing the market, or copying TikTok/Reddit trends.

Use a simple budgeting formula (like 50/30/20) to balance bills, lifestyle, savings, and investments without burnout.

🚫 False Belief of the Week

“I’ll start building wealth when I earn more.”

If you wait for a higher salary, you’ll miss the years where compounding does the heavy lifting.

Start now—small amounts grow big with time.

📈 Smart Move of the Week

Pick ONE platform (Endowus, FSMOne, Syfe, DBS Invest-Saver).

Set up a recurring monthly investment into a diversified ETF or portfolio.

Do not touch it. Do not time the market.

Just let it grow.

🧱 Quick Principle to Remember

You don’t need big money to start—

you need a system that runs even when you’re busy.

🧭 Before You Head Off — A Few Resources to Level Up Your Journey

If today’s insights got you thinking, don’t let the momentum fade. I’ve gathered a set of powerful tools and long-term investing resources designed to help you keep learning, stay focused, and build wealth with intention.

For those ready to go deeper, explore Iris Stock Trading—a clean, intuitive way to track your trades and stay accountable. And if you want to automate more of your financial life, JazTAD offers a streamlined system to help you stay consistent without the overwhelm.

For more self-growth resources, check out this link right here!

Each recommendation is carefully chosen to support the habits that matter most: clarity, discipline, and principle-first growth. Keep building. Your future self will thank you.

Final Takeaways✨

Building wealth in your 20s and 30s isn’t about having everything figured out—it’s about taking small, intentional steps that compound over time. You don’t need the “perfect” income, the “perfect” timing, or the “perfect” investment. What you do need is consistency, clarity, and the courage to start.

Remember this: every dollar you save, every investment you automate, every financial mistake you avoid—it all adds up. Your future wealth is shaped by the habits you build today, not by the amount you earn tomorrow.

So take the first step, no matter how small. Keep learning, stay disciplined, and trust the process. Your financial future isn’t built in a day—but it is built day by day.

Let’s keep growing, let’s keep investing, and let’s keep building wealth together—one smart move at a time.